States' PTE Tax Elections: Status and Issues to Consider

31 March 2022

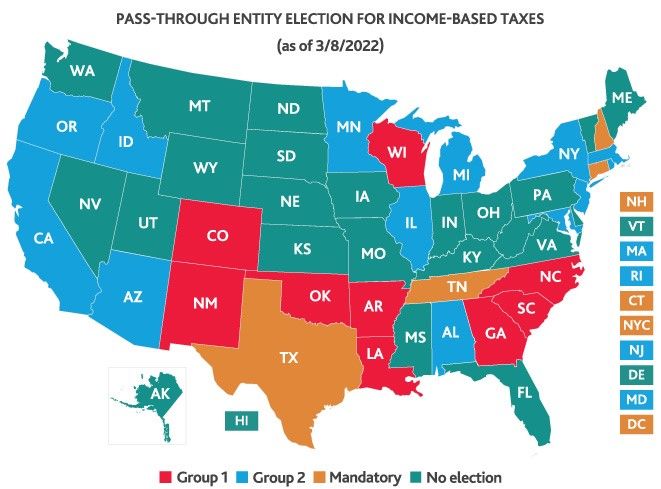

More than 20 states now allow pass-through entities (PTEs) to elect to be taxed at the entity level as a workaround to the $10,000 federal state and local tax (SALT) deduction limitation known as the “SALT cap.” Legislation that would enact similar elective PTE tax regimes is pending in several other states, including Iowa, Mississippi and Virginia.States have generally approached the creation of these elective PTE tax regimes one of two ways. “Group 1” states, such as Colorado, North Carolina and Wisconsin, allow members of a PTE to reduce their adjusted gross income by their pro rata or distributive share of income from the PTE if the entity elects to be taxed at the entity level. “Group 2” states (e.g., California, Illinois and New York), on the other hand, allow PTE members to take a credit to offset their taxable income, but still require the members to include their distributive share of income in their tax returns. Connecticut is the only state that has created a mandatory PTE tax in response to the SALT cap. A handful of other jurisdictions (District of Columbia, New Hampshire, New York City, Tennessee and Texas) have historically imposed entity-level taxes on PTEs.

While the intent behind these PTE tax elections is to benefit members of eligible PTEs, they are not simple elections to make, nor should they be entered into lightly. There are a host of issues to consider, both from a compliance perspective and from an overall tax perspective, and a holistic evaluation of whether to make a state’s election will compare the total federal and state (PTE’s, resident members and nonresident members) net tax cost with and without the election. The following is a list of some of the most important issues to consider from a holistic perspective, and is accompanied by examples of the different kinds of approaches that individual states take with such issues, as well as a map of the PTE tax regime status across the U.S.

Making a PTE Tax Election and Compliance Issues to Consider

When must the election be made?

- Arizona – The election must be made by the due date, or the extended due date, of the business’s return, but owners must be given 60 days’ notice.

- Michigan – The election to be made by the 15th day of the 3rd month of that tax year (i.e., March 15, 2022, for a calendar year taxpayer to make the election for the 2022 tax year).

Is the election binding or annual?

- Alabama – The election is binding until revoked.

- Arkansas – The election is made annually.

Is the election irrevocable?

- Georgia – The election is irrevocable.

- New Jersey – The election can be revoked electronically by the original due date of the return.

How do you make the election?

- Michigan – For now, the election is made by making an electronic payment, until the Department of Treasury creates a specific election form or includes instructions on the PTE tax form.

- Wisconsin – The election is made on the PTE’s annual return.

Who is authorized to make the election on behalf of the PTE?

- Alabama – The election must be made by the PTE’s governing board or by greater than 50% voting control of the PTE.

- Idaho – The election must be made by each member of the PTE, or by an officer, manager or member authorized by law of the PTE’s organizing documents authorized to make an election.

- Maryland – The enacting bill is silent on this issue.

Can tiered partnerships or PTEs with non-individual members make the election?

- Georgia – It depends. PTEs can only make the election if all of the PTE’s members are eligible to be S corporation shareholders.

- Michigan – Qualified PTEs are not precluded from making the election if they have a tiered-partnership structure or corporate partners.

Are electing PTEs still required to comply with withholding or composite requirements?

- Illinois – Electing PTEs are not required to withhold on behalf of nonresident owners.

- Maryland – Electing PTEs cannot file a composite return on behalf of any members.

- New Jersey – An electing PTE is still responsible to remit tax on behalf of its nonresident partners in accordance with N.J.S.A. 54A:12-3c. The election made by a PTE to pay the pass-through business alternative income tax at the entity level does not eliminate the requirement to file any other tax return or pay any other tax that is required of the PTE.

Are nonresident members of electing PTEs still required to file returns?

- Arkansas – No, nonresidents are not required to file individual returns if they have no other Arkansas-source income.

- New Jersey – Yes, nonresidents are still required to file returns if they meet the state’s gross income tax filing thresholds.

General Tax Issues to Consider

What is the tax rate?

- Minnesota – The highest individual income tax rate in Minnesota is 9.85%.

- New York – New York uses a graduated rate that reaches up to 10.9% if the PTE’s tax base is over $25 million.

How is the electing PTE’s tax base calculated?

- Colorado – The tax base is the sum of each electing PTE owner's pro rata or distributive share of the electing PTE's income attributable to Colorado and each resident electing PTE owner's pro rata or distributive share of the electing PTE's income not attributable to the state.

- Louisiana – The tax base is calculated “as if” the electing PTE were a C corporation for federal tax purposes.

- Michigan – Electing PTEs calculate and pay tax due only on the business income tax base allocable to those members who are individuals, flow-through entities, estates or trusts and exclude the business income tax base allocable to those members that are corporations, insurance companies or financial institutions.

How do members of the electing PTE report their share of income?

- Arkansas (a Group 1 state) – Members exclude their share of PTE items that are subject to tax under the PTE tax election.

- California (a Group 2 state) – “Qualified taxpayers” include their pro rata or distributive share of income in their California return, which then may be offset with a credit.

Are net operating losses allowed, for the electing PTE or its members?

- Arkansas – Net operating losses generated by the PTE do not flow through to owners. Net operating losses may be carried forward by the PTE.

- Wisconsin – Electing PTEs cannot claim net operating loss deductions.

How do members of the electing PTE calculate their credit?

- Arizona – The credit is calculated as a portion of the tax paid by the electing PTE that is attributable to the partner’s or shareholder’s share of income taxable in Arizona. The credit is not refundable, but it can be carried forward for five years.

- Massachusetts – A qualified member receives a refundable credit against their Massachusetts income tax. This credit is equal to the qualified member’s proportionate share of tax due and paid by the eligible PTE, multiplied by 0.9.

- Oregon – Members can claim a refundable personal income tax credit for their pro rata share of the Oregon PTE tax paid.

Can non-individual members take a credit? If so, is it refundable?

- Alabama – Corporate partners are entitled to a refundable credit.

- New Jersey – For tax years before 2022, corporate partners are entitled to a credit, but it is not refundable and can be carried forward for 20 years.

Are non-residents allowed to take an “other state tax credit” on their resident state income tax return for elective PTE taxes paid in another state?

- Arizona – Yes, for substantially similar PTE income taxes paid to other states.

- Colorado – No. However, electing PTEs in Colorado can claim credits for taxes paid to other states on income that is subject to entity-level tax in other states.

- Indiana – No.

The issue of whether non-residents may take other state tax credits on their resident state income tax return is one of the most important issues to evaluate for SALT purposes. If a state does not allow another state tax credit for elective PTE taxes paid, then an individual may be trading a dollar-for-dollar state tax credit for a $0.37 federal income tax deduction by making a PTE tax election.

Federal Income Tax Issues to Consider

In addition to the aforementioned high-level state issues, there are also federal income tax issues to consider, such as:

- In which tax year can an electing PTE that is an accrual method taxpayer take a deduction for elective PTE taxes paid?

- Is an owner’s state tax refund attributable to the PTE tax credit considered taxable income?

- How is the state tax expense of an investment partnership treated?

- May the PTE’s state tax expense be specially allocated only to those partners whose income was included in the PTE’s state tax base?

Insights

- Regardless of whether your business is a local partnership operating in one state with only a few members or a multi-state entity with members in all 50 states, consider modelling the overall tax impact from making the election at both the federal and state level.

- The evaluation of whether to make a state PTE tax election should be made from a holistic perspective.

- We can advise PTEs and their members using a holistic approach to determine whether they should make an election, discuss the benefits and potential pitfalls and model the overall tax impact of a potential election.

For more information, reach out to our Tax Team.